Tax Benefits

Endow Maryland provides an incentive for Marylanders to give back to their local communities in a meaningful and lasting way. You could qualify to receive a 25 percent Maryland tax credit when you give a gift between $500 and $60,000 to a permanent charitable fund, in addition to the federal charitable deduction allowed for the gift.

How does it work?

Community Foundations in Maryland are sharing $250,000 in tax credits for 2025. These credits are available on a first-come, first-served basis.

Donors who make charitable contributions between $500 and $60,000 to qualified permanent funds are eligible to receive a 25 percent Maryland tax credit. In addition, your gift may be eligible for a federal charitable tax deduction, depending on your tax status. Please consult your financial advisor about your specific situation. Gifts can create new permanent funds or add to existing permanent funds that benefit individuals or organizations in Maryland. Funds with donor participation do not qualify.

How to make a $1,000 donation cost only $750 – even without itemizing.*

*This is an example. Consult your financial advisor about your specific situation.

How Can I Apply?

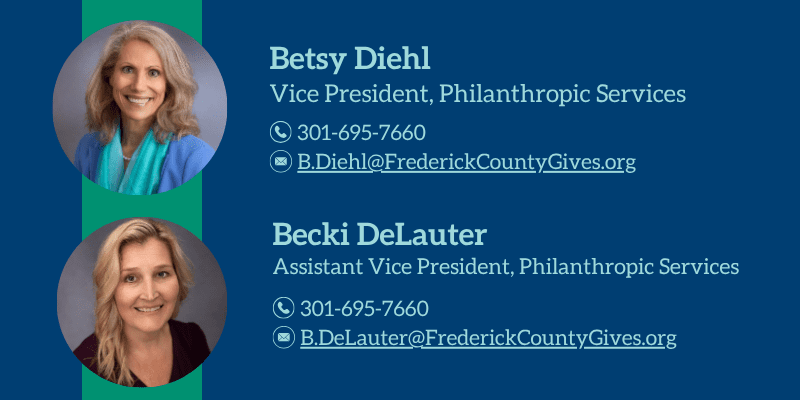

We’re here to help! Please connect with us to learn more and verify that the fund you wish to support is eligible.

Information for Professional Advisors

Download this important bulletin by Venable LLP, “Effect of IRS Regulations on Endow Maryland Tax Credit” published July 29, 2019.